Recently many strata’s are experiencing higher strata insurance rates because of increased climate related events. The article from the CBC outlines that higher rates and coming. The implications of this new world will have a startling effect on the relationship between members and their council.

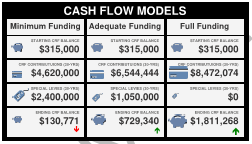

Most council’s have a warm and friendly relationship with their members, but, increasingly, underfunded Contingency Reserves barely cover emergency repairs and basic system upgrades. The other effect of these increased insurance costs with higher deductibles, is strata’s may need to put aside fees as a part of their depreciation report cycle every three years to be able to cover these higher deductibles without having to issue special assessments.

If the strata doesn’t have the contingency, then special assessments to cover insurance deductibles will become the norm, or more likely, the individual owner that may cause issues in the building, will be on the hook for the difference. Some of these costs may be catastrophic and may lead to much stress and strife between members.

The best course of action is to get an accurate depreciation report and start doing preventative maintenance on systems that are due to renew. A very simple example, would be to instruct members change all exposed piping in building to braided lines to minimize their likelihood of causing a leak. There are many things strata’s can do and should do … the main thing is not to put your head in the sand because the alternatives will be much more costly and stressful. The best way, is to view this as an opportunity to meet your neighbors and work collaboratively to reduce your shared and individual risk of living in a BC Strata.